February 17, 2026

Manufacturing Production – December 2025

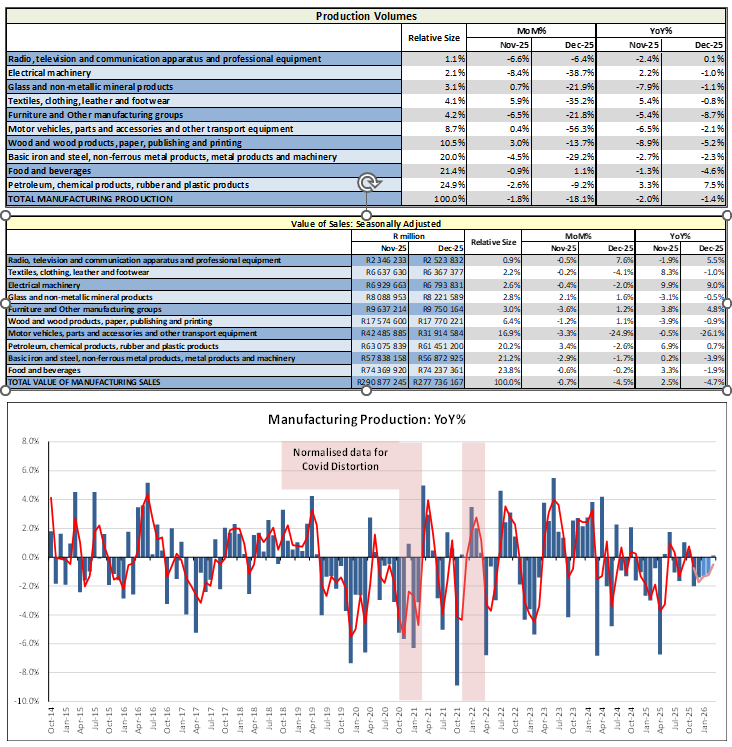

In December, South Africa’s manufacturing output declined by 1.4%, following a modest 2.0% decrease in November. This fall exceeded market expectations, which had anticipated a 0.8% drop for December. During the same period, the Purchasing Managers’ Index (PMI) fell 1.5 points, from 42.0 in November to 40.5 in December 2025. This indicates a less favourable business environment for manufacturers during the month under review.

The iron and steel sector contracted by 2.3%, contributing to a 0.4 percentage-point reduction in overall manufacturing growth. Similarly, the wood and wood products industry saw a 5.2% decline, further reducing growth by an additional 0.6 percentage points. The food and beverages sector also contracted by 4.6%, contributing an extra 1.4 percentage points to the decline in manufacturing output for November. These sectors were significant contributors to the industry’s poor performance.

On a more positive note, seasonally adjusted manufacturing production increased by 0.5% in the fourth quarter of 2025 compared to the previous quarter. Out of ten sectors, eight reported contractions during this period. Significant contractions included:

- Motor vehicles, parts, and accessories, along with other transport equipment, contracted by 6.0%, subtracting 0.5 percentage points from growth.

- The wood and wood products, paper, publishing, and printing sectors, which fell by 2.0%, resulting in a 0.2 percentage point decrease in output.

- The food and beverages sector, which decreased by 0.9%, also contributed a 0.2 percentage point reduction.

Seasonally adjusted manufacturing sales decreased by 2.5% during the fourth quarter compared to the previous quarter. Significant declines occurred in:

- Motor vehicles, parts, and accessories, as well as other transport equipment, which declined by 11.6%, subtracting 1.8 percentage points from sales growth for the quarter.

- The food and beverages division, which contracted by 1.9%, reducing total sales growth by 0.5 percentage points.

Manufacturing is a critical component of South Africa’s economy, employing approximately 1.6 million people and accounting for 12.5% of the GDP in 2024. Employment slightly decreased from 1.672 million in Q2 2025 to 1.610 million in Q3 2025. Nonetheless, GDP figures for the third quarter indicate a 0.3% quarterly increase in manufacturing output.

Challenges are expected from the third quarter onward, partly due to US trade tariffs that are affecting production, sales, and employment. Business owners remain cautious amid concerns about US tariffs on exports and ongoing US-China trade tensions, especially in light of December’s manufacturing data. This cautious sentiment may be heightened by the introduction of a 30% tariff on South African goods entering the US market, effective from August 7, 2025. However, companies are maintaining substantial cash reserves of approximately R1.8 trillion, up from R1.1 trillion in the first quarter of 2025, according to the Reserve Bank. This reflects a prudent approach amid current domestic and global economic uncertainties in the short to medium term.