February 19, 2026

A view on Demand in the Economy: Retail Sales performance – December 2025 Data

South Africa’s retail sector closed 2025 on a modest but encouraging note, with December sales reflecting a gradual recovery in consumer demand. While easing inflation and recent interest-rate cuts have provided some support, households remain under pressure from rising living costs, slow wage growth, and global trade uncertainties, keeping spending patterns cautious despite improving economic sentiment.

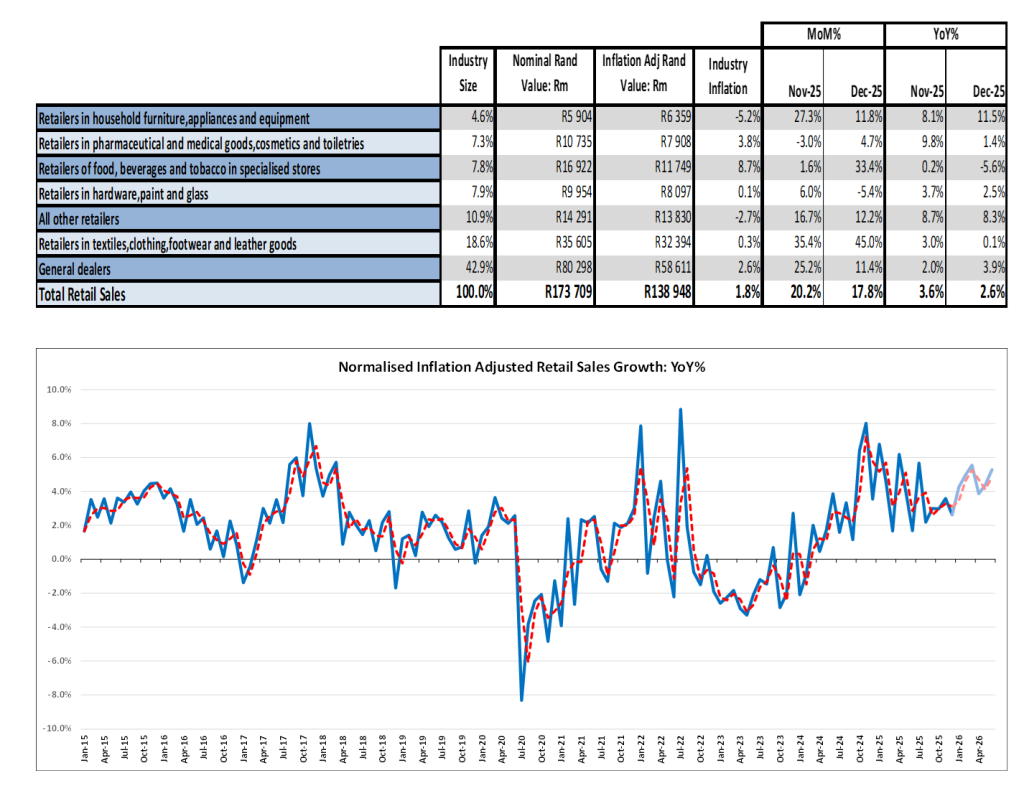

In December, retail sales in South Africa rose by 2.6%, well below the 3.7% analysts had anticipated. This growth still underscores a continued recovery in consumer demand.

Households, however, still face several challenges. The South African Reserve Bank and January 2026 consumer inflation data point to ongoing increases in administered prices and housing and utility costs, each rising by more than 4.0%. Sluggish wage growth amid limited economic expansion remains a concern, while uncertainties in international trade — including diplomatic tensions between Washington and Pretoria and the lapse of the African Growth and Opportunity Act (AGOA) in September 2025 — have weighed on domestic demand and encouraged cautious spending through late 2025.

December’s 2.6% gain continues a recovery trend from April to December, likely supported by interest-rate cuts and monetary easing implemented between September 2024 and November 2025. The South African Chamber of Commerce and Industry (SACCI) recorded a small increase in business confidence (index up from 132.3 in November to 133.2 in December 2025). The FNB/BER consumer confidence index also improved slightly, from -13 in 2025Q3 to -9 in 2025Q4, reflecting persistent consumer caution. Although inflation is relatively low and the Reserve Bank reduced rates in January, July and November 2025, the full effects on consumer behaviour will take time to materialise as interest rate changes can take up to 18 months to filter through the economy.

December’s retail growth was driven by:

- Other retailers: up 8.3%, contributing 0.8 percentage points

- General dealers: up 3.9%, contributing 1.6 percentage points

- retailers in household furniture, appliances and equipment: up 11.5%, contributing 0.5 percentage points

The sustained momentum since July suggests a steady, if cautious, recovery. Interest-rate cuts from September 2024 to November 2025 have eased some household financial pressure and supported demand over the past five months, although the effects of monetary policy typically unfold over 12–24 months. Maintaining this momentum is important: consumer spending is a key driver of growth and employment, particularly after GDP expanded by 0.5% in 2025Q3. The November 2025 rate cut supported consumer demand in December 2025 and could lift it further in early 2026.