February 17, 2026

Mining Production and Sales for December 2025

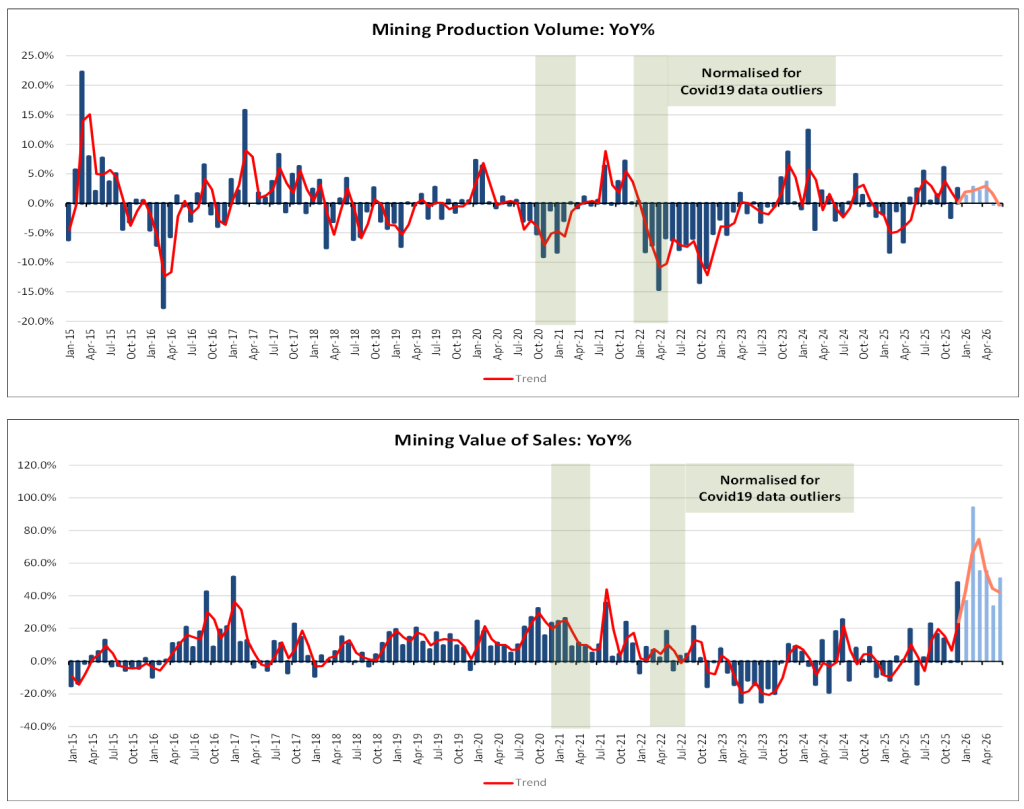

In December 2025, South Africa’s mining activity rose 2.5% year-on-year, rebounding from a 2.4% decline in November. This growth was predominantly driven by:

- A 19.0% increase in iron ore production, which contributed 2.7 percentage points to the overall mining output for the month.

- A substantial 40.4% rise in manganese ore output, adding another 2.4 percentage points.

For the fourth quarter of 2025, seasonally adjusted mining output decreased by 0.5% compared to the previous quarter. This decline was primarily due to:

- A 2.9% drop in platinum mining, which decreased total mining production by 0.8 percentage points.

- A 3.6% fall in coal production, deducting 0.9 percentage points.

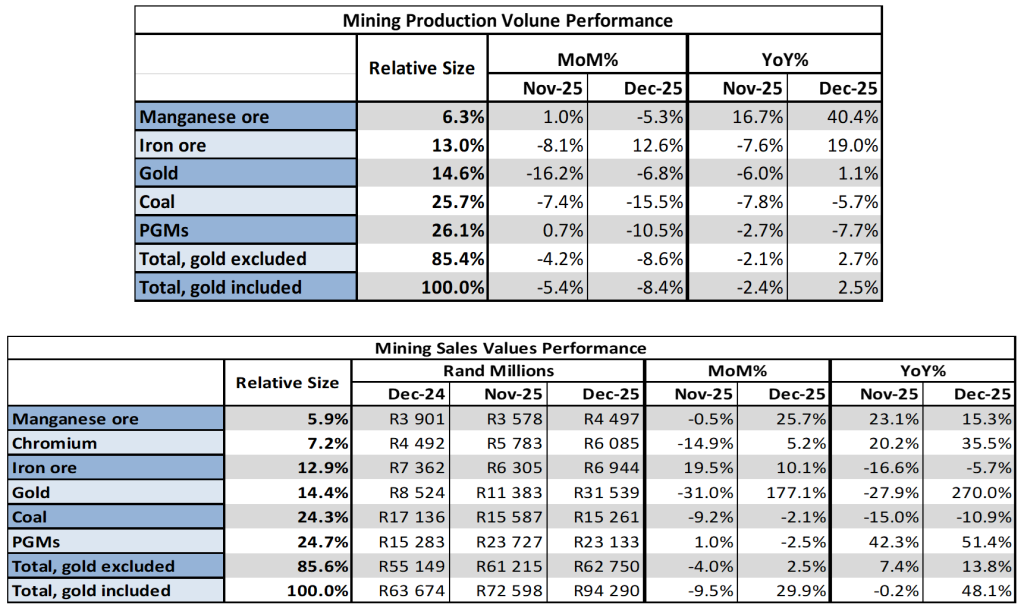

In December, nominal mining sales rose 48.1%. This positive trend was notably supported by:

- A 51.4% surge in platinum sales, which added 12.3 percentage points to overall mining sales growth.

- An impressive 270.0% rise in gold sales, contributing 36.1 percentage points.

- Chromium ore sales, which grew by 35.5%, added another 2.5 percentage points.

The mining sector remains vital to South Africa’s economy, generating foreign exchange and employing approximately 444,000 people, a slight decrease of 5,000 from the previous quarter, according to StatsSA labour statistics for the fourth quarter of 2025. According to the latest GDP data, the sector grew by 2.3% from the first to the third quarter of 2025, with growth also projected for the fourth quarter. This third-quarter growth and anticipated fourth-quarter growth are encouraging, given the sector’s importance to employment and foreign earnings.

Despite a slight decrease in employment from the previous quarter, the sector’s continued significance is evident. However, challenges persist, including concerns over exports to the US following new tariff measures introduced on 7 August, proposed export tariffs on manganese, and import tariffs on steel exports to the Eurozone. The sector also faces challenges related to the loss of AGOA benefits in September and ongoing issues with the new Mining Charter.

On the international stage, geopolitical tensions between the US and China—marked by trade conflicts and tariff disputes—continue to disrupt global markets and limit trade flows. Nonetheless, some positive developments have emerged, such as the temporary exemption of certain mining materials used in steelmaking from high US tariffs. This provides some relief for the sector, which remains crucial to South Africa’s economy in terms of employment, foreign exchange, and overall growth.