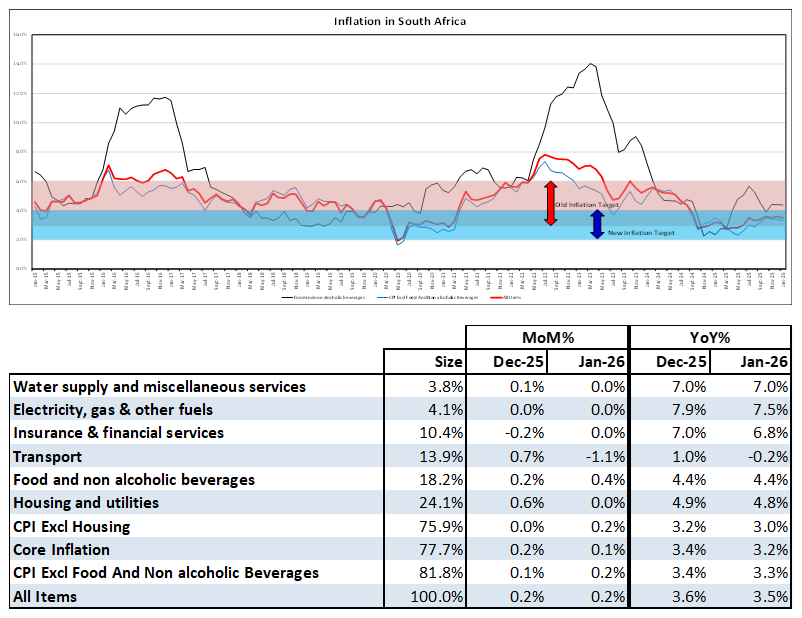

In January 2026, the Consumer Price Index (CPI) rose 3.5% year-on-year, marginally less than the 3.6% recorded in December and slightly below analysts’ forecast of 3.7%. The increase in consumer prices was primarily driven by:

- Housing and Utilities: Increased by 4.8%, contributing 1.2 percentage points.

- Food and Non-Alcoholic Beverages: Rose by 4.4%, contributing 0.8 percentage points.

- Insurance and Financial Services: Increased by 6.8%, contributing 0.7 percentage points.

Year-on-year, inflation for goods fell slightly from 3.0% in December to 2.8% in January, while services inflation was unchanged at 4.2% from December 2025 to January 2026. Notably, the inflation rate for services has remained above the Reserve Bank’s upper limit of 4.0% within the new inflation target range. This sustained increase in services inflation continues to erode household purchasing power in South Africa. As a result, many families are increasingly relying on short-term credit to maintain their consumption, making them more vulnerable to fluctuations in interest rates, exchange rates, and import prices, which can, in turn, affect domestic prices.

During its November meeting, the Reserve Bank’s Monetary Policy Committee (MPC) decided to reduce interest rates by 25 basis points, lowering the prime overdraft rate to 10.25% in South Africa. The Reserve Bank, however, kept interest rates unchanged at the end of January 2026 meeting of the MPC, where January 2026 inflation numbers and forecasts were considered. The Reserve Bank is expected to remain vigilant about inflation, particularly after revising the inflation target range downward from 3-6% to 3%, with a permissible deviation of one percentage point in either direction. This cautious stance aims to maintain price stability amid ongoing economic uncertainties, including the 30% trade tariffs imposed by the US on South African exports. Such uncertainties may also influence the Rand’s exchange rate against the US dollar in the coming months, despite recent tariff concessions granted to specific sectors within the agricultural industry.

The South African Reserve Bank (SARB) may contemplate a further 25-basis point interest rate reduction at their next meeting in March if low inflation numbers and a relatively stable Rand Dollar exchange rate continue to hold, while international oil prices also remain stable.

The interest rate cuts implemented in late 2024 and throughout 2025, along with the reduction in November 2025, are expected to stimulate demand by increasing households’ disposable income after interest payments, thereby supporting economic growth. This outlook aligns with StatsSA’s latest economic growth figure of 0.5% for the third quarter of 2025.

Despite a continued positive growth outlook that slightly exceeds market expectations, the Reserve Bank remains cautious due to persistent global uncertainties. Factors such as inflation, the US-China tariff dispute, and potential further tariffs affecting BRICS nations could impact price stability, while the tensions building in the Middle East, particularly between the US and Iran, may cause international oil prices to increase violently if an armed conflict ensues and the Strait of Hormuz is closed off as a consequence. Future interest rate decisions are likely to take into account moderate inflation within the new target band, sluggish economic growth, improvements in electricity supply, positive market sentiment, and international tensions that will affect the oil price going forward.

In conclusion, maintaining price stability and protecting the Rand’s value remain top priorities as South Africa navigates the early months of 2026, given current international developments and the uncertainty they have generated.