May 22, 2025

All in one day

Ramaphosa, Trump and the Budget 2025

South Africa in 2025: A Conservative Path to Stability, Growth, and Diplomatic Reconciliation

Diplomatic Tensions and Strategic Opportunities

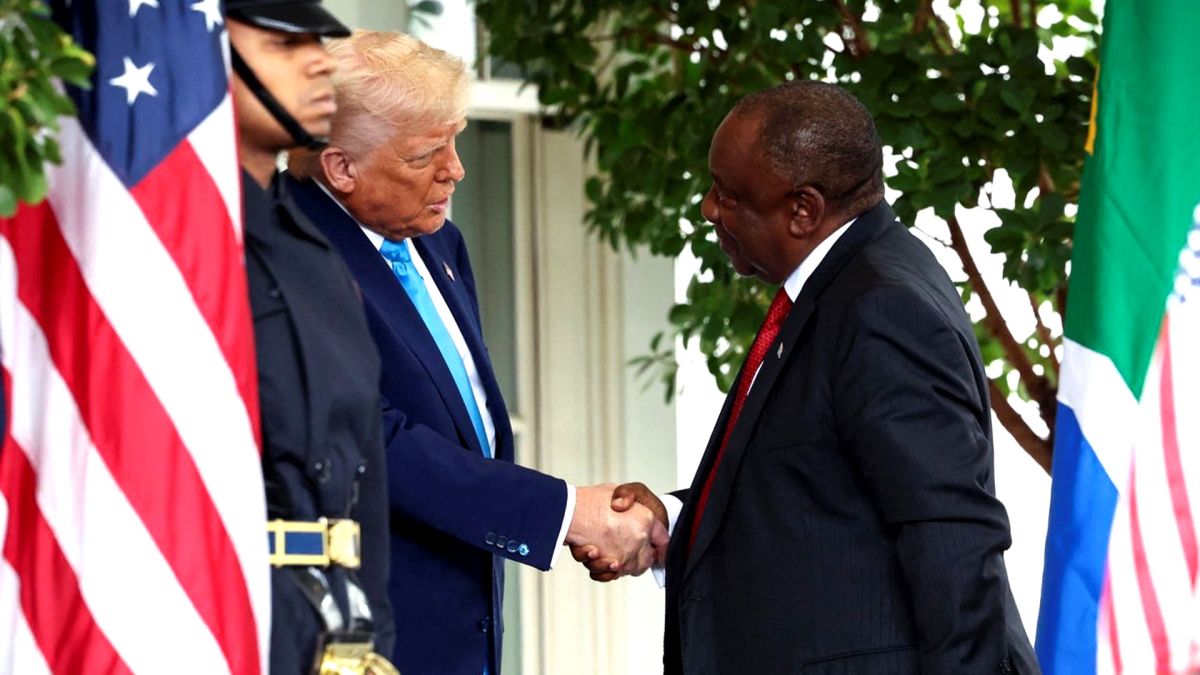

The bilateral encounter at the White House was characterised by tension, largely stemming from allegations of violence against white farmers and the suspension of over $430 million in U.S. aid—primarily funding HIV/AIDS and education programs. These developments, compounded by contentious issues surrounding Black Economic Empowerment (BEE) laws, especially as it relates to the Starlink issue and other investment into South Africa and accusations of genocide targeted at minorities, threaten to undermine the country’s international credibility and investor confidence.

However, President Ramaphosa’s firm rejection of these claims and his proactive appointment of a Special Envoy signal a desire and urgent need to repair this strained relationship and diplomatic standing. A successful diplomatic reset could pave the way for renewed trade, investment, and infrastructure projects—key drivers for economic growth. Rebuilding trust with America and other traditional allies is essential to securing strategic partnerships, particularly in energy, mining, and green technologies, sectors where South Africa has competitive advantages.

Fiscal Discipline and Structural Reforms

The 2025 Budget Speech underscored a conservative, reform-oriented approach aimed at restoring fiscal health. With a revised GDP growth forecast of just 1.4%—lower than earlier predictions—and a debt-to-GDP ratio expected to stabilise at approximately 77.4%, the government prioritized fiscal prudence. Notably, the decision against increasing VAT or expanding social grants reflects a sound effort to limit government overreach, reduce dependency, and protect taxpayers.

Key fiscal measures include:

- Over R1 trillion allocated to critical infrastructure—transport, water, and energy—to foster a resilient economy.

- Emphasis on public-private partnerships to accelerate infrastructure projects and reduce reliance on government funding.

- Expenditure controls aimed at limiting waste and ensuring efficient resource allocation, coupled with reforms to improve tax compliance and revenue collection through the modernization of SARS.

These policies echo conservative principles: limited government, market-led development, and institutional strengthening. Enhancing fiscal discipline provides the foundation for long-term stability even amid global economic headwinds.

Addressing Sectoral Challenges Amid External Risks

South Africa’s economy exhibits resilience but faces significant obstacles:

- Unemployment remains high at around 32.9%, with notable job losses in construction, trade, and domestic services.

- The mining sector, employing roughly 431,000 workers, remains vital for export revenue. Infrastructure and regulatory reforms are critical to catalyse growth in this resource-based industry.

- External risks—such as potential loss of trade privileges like AGOA, currency volatility, and rising geopolitical tensions—introduce uncertainty. Nevertheless, diversification efforts, including increased exports to India, demonstrate proactive resilience.

The Reserve Bank’s cautious monetary stance aims to maintain currency stability, an important buffer against external shocks. However, diplomatic frictions—particularly over issues like the EWC debate—pose a risk to investor confidence and international cooperation. Rebuilding trust with Western partners remains a strategic priority.

Strategic Path Forward: Conservative Principles for Long-Term Growth

Success hinges on the government’s ability to adhere to conservative, disciplined policies:

- Continued commitment to responsible fiscal management, reducing waste, and controlling public debt.

- Strengthening anti-corruption measures and transparency to restore public trust.

- Fostering private sector-led growth through targeted reforms that ease regulatory burdens and attract foreign direct investment.

- Diversifying trade partners, especially across Africa and Asia, to mitigate external vulnerabilities.

- Strategic international diplomacy aimed at restoring and maintaining mutually beneficial alliances, essential for stability and economic vitality.

Conclusion

While South Africa confronts internal and external headwinds – rising unemployment, political tensions, and global economic uncertainties – its prospects for renewal remain promising. A prudent, conservative approach that emphasises fiscal discipline, institutional integrity, and strategic diplomacy positions South Africa to navigate turbulent waters. By consolidating its strengths and adhering to core principles of limited government, free enterprise, and sovereign resilience, South Africa can institutionalise long-term stability and foster sustainable prosperity for all its citizens in the future.