May 29, 2025

Navigating Economic Transition

Another 25-basis Point Interest Rate Cut

South Africa’s Strategic Response to Global Volatility

Monetary Adjustments in a Perturbed Global Economy

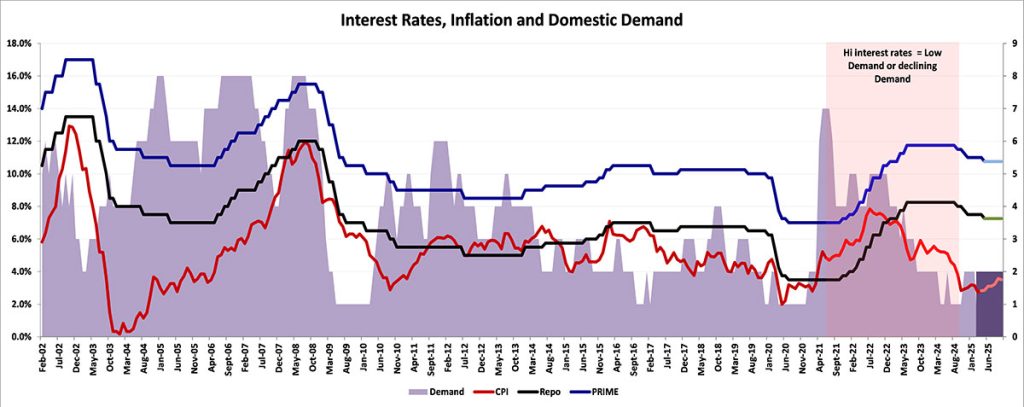

The decision to reduce the policy rate by 25 basis points—settling the repo rate at 7.25% and the prime lending rate at 10.75%—comes in response to a complex global environment. Recent trade tensions, particularly involving the United States, have led to increased market volatility, causing fluctuations in tariffs and prompting safe-haven investments in assets like gold and the Euro. These developments have necessitated a re-evaluation of global growth forecasts, leading several central banks, including the European Central Bank and the Bank of England, to lower their rates.

In South Africa, economic indicators, though hampered by underperformance in sectors like mining and manufacturing and a rise in unemployment, suggest cautious optimism. Despite a downward adjustment to GDP growth projections—now at 1.2% for 2025, with a gradual uptick to 1.8% by 2027—structural reform initiatives continue to bolster economic fundamentals. Inflation, too, remains subdued, with April’s CPI at 2.8%, benefiting from lower fuel costs and a robust Rand against some of the major currencies internationally, even amidst slight volatility earlier in the year.

Strategic Economic Outlook

The SARB’s rate cut, supported by five of the six MPC members, further signals a commitment to supporting economic recovery without compromising inflation targets. With projections revised downwards due to a stronger exchange rate and reduced global oil prices, the MPC aims to steer inflation closer to the lower end of its target range, exploring the feasibility of maintaining it at 3%. Such a move would potentially allow for further rate reductions, fostering conducive conditions for growth while maintaining price stability.

The MPC remains vigilant, acknowledging the potential risks posed by global economic headwinds. Scenarios considered, such as one involving rampant trade tensions leading to a depreciating Rand, highlight the possibility of stagflation—a scenario the SARB is keen to avoid. By anchoring inflation expectations and maintaining policy flexibility, the Reserve Bank aims to safeguard the economy from such adverse outcomes.

Implications for Business and Investment

For businesses and investors, the latest monetary easing presents an opportunity. Reduced borrowing costs are anticipated to invigorate sectors reliant on credit, including construction and infrastructure, while stable inflation reinforces macroeconomic confidence. Nevertheless, stakeholders are advised to remain agile, keeping a close watch on factors such as oil price fluctuations, exchange rate movements, and geopolitical developments which might affect future policy directions.

Conclusion

Amidst ongoing global uncertainties, South Africa’s monetary policy, characterised by its conservative stance, remains focused on fostering economic resilience through strategic reforms and prudent fiscal management. By continuing to prioritise structural improvements and price stability, the country is poised to achieve sustainable growth, reinforcing its position as a robust player in the regional and global economy. As the SARB remains data-dependent, its efforts to create an environment conducive to economic recovery will be central to South Africa’s trajectory in the coming years.