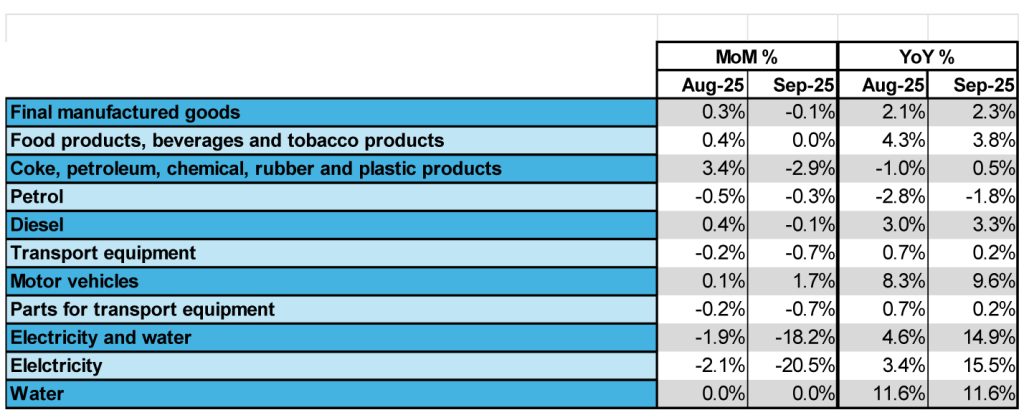

In September 2025, producer price inflation increased to 2.3%, up from 2.1% in August. On a monthly basis, however, producer prices declined slightly by 0.1%. Notably, costs for food and beverage production rose once again by 3.8%, contributing 1.1 percentage points to the monthly increase.

The previous deflationary trend in producer inflation appears to have ended, with only petrol prices continuing to decline—petrol prices decreased by 1.8% on an annual basis in September 2025.

In September 2025, producer price inflation increased to 2.3%, up from 2.1% in August. On a monthly basis, however, producer prices declined slightly by 0.1%. Notably, costs for food and beverage production rose once again by 3.8%, contributing 1.1 percentage points to the monthly increase.

The previous deflationary trend in producer inflation appears to have ended, with only petrol prices continuing to decline—petrol prices decreased by 1.8% on an annual basis in September 2025.

Production costs for intermediate goods rose by 7.6% in September, following a 6.5% increase in August. This indicates a clear inflationary trend that warrants attention. This level of increase exceeds the South African Reserve Bank’s (SARB) inflation target range of 3% to 6%. Additionally, the month-on-month increase of 1.1% further suggests that inflationary pressures are beginning to manifest in the manufacturing of intermediate goods. The annual growth is still largely influenced by base effects from 2024 data.

The primary contributor to the monthly increase was Basic and Fabricated Metals, which rose by 2.8%, adding 1.5 percentage points to the overall figure.

In the primary sector, mining costs grew by 16.0% in September, following an 8.5% increase in August. Conversely, the agriculture sector experienced a 2.1% decrease after a 3.0% rise in August.

Overall, the trend in producer price inflation for final manufactured goods remains supportive of favourable inflation expectations in South Africa in the short to medium term. Consumer inflation remains low at 3.4% for September, closely aligning with the SARB’s target of 3%. Although prices for certain intermediate goods—particularly water and electricity—are still above the target range, current figures suggest that consumer inflation is likely to remain low and stable in the near future. This stability may provide the Reserve Bank with room to consider further interest rate reductions later in 2025, as both consumer and producer inflation expectations appear to be well managed at present.